POPIA finally became effective as of 1 July 2020 by the proclamation thereof in the Government Gazette. This now means that all public and private bodies will have to be fully compliant with the requirements of the Act by 30 June 2021!

POPIA finally became effective as of 1 July 2020 by the proclamation thereof in the Government Gazette. This now means that all public and private bodies will have to be fully compliant with the requirements of the Act by 30 June 2021!

Flexible work arrangements have become increasingly popular as the needs of employers and employees change in response to the coronavirus (COVID-19) pandemic.

Eksekuteursvergoeding waarop die Eksekuteur van u boedel geregtig is, word deur Wetgewing gereguleer en beloop tans 3,5% (Plus BTW) van die totale batewaarde van u boedel.

U begroting klop nie en u moet aan uitgawes sny. U wil ‘n kontrak kanselleer, maar is gebind deur ‘n vaste termyn ooreenkoms. Mag u die kontrak kanselleer? Weet u wat u regte is in terme van die Verbruikersbeskermingswet?

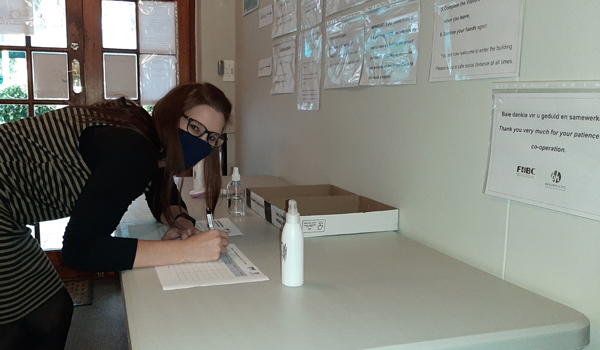

Steeds mag al die werknemers nie voltyds by die kantoor werksaam wees nie. Ons Covid komitee sorg deurentyd dat ons aan die sosiale afstand kriteria voldoen en dat ons binne wetgewing met mekaar interaksie het. Ons het twee kollegas gegroet, ons het aan Tekkie Tax deelgeneem, en so terwyl ons uit en tuis is, het ons ‘n paar sopresepte met mekaar gedeel.

Op 3 Julie 2020 het die Kommissaris van die Suid-Afrikaanse Inkomstediens, Edward Kieswetter, die regulasies bekragtig wat bepaal wie inkomstebelastingopgawes moet indien vir die 2020 jaar van aanslag. Hierdie artikel gee ʼn uiteensetting van die persone wat opgawes moet indien en van diegene wat in 2020 vrygestel is van die indiening van opgawes.

‘n Testament is nodig om effektiewe opvolging te verseker, maar dit is net so belangrik dat u testament geldig, korrek en op datum moet wees.

Tans is ons in “advanced level 3 lockdown” en ons leer daagliks om aan te pas met die veranderde wêreld van werk en interaksie. Een kollega het aan die aanlyn Comrades deelgeneem, ons het ‘n kollega gegroet, en ons werk voort deur van aanlynplatforms gebruik te maak.

Veral in hierdie krisis-tyd waarin Suid-Afrikaanse besighede hul tans bevind, is dit noodsaaklik dat Direkteure met erns ag slaan op hulle verantwoordelikhede en die gevolge van die nie-nakoming daarvan.

Section 10(1)(e)(i) of the Income Tax Act states the first requirement for tax compliance which consequently gives rise to the need for a Body Corporate, a Share Block scheme and Association of people to register as a taxpayer. A body corporate automatically receives exempt income status in terms of these sections, but a home owners’ association needs to apply for exemption.

Om u Testament-sake op datum te bring is beslis ‘n stap in die regte rigting, maar die belangrikheid om ook u Eksekuteur reg te kies, kan nie genoeg beklemtoon word nie.

Met die aanbreek van die vlak-3 inperkings was beraam dat ongeveer 8 miljoen persone vanaf 1 Junie 2020 na hul werksplekke kon terugkeer. Is u maatskappy gerat vir hierdie terugkeer?