First things first – what is a travel allowance?

First things first – what is a travel allowance?

Section 8(1)(b) of the Income Tax Act 58 of 1962 makes provision for a travel allowance. In terms of this section a travel allowance means any allowance paid or advance given to an employee in respect of travelling expenses for business purposes. Thus, any other travelling for example the employee travelling from his/her place of residence to his/her place of work or any other travelling for private or domestic purposes, does not qualify to form part of a travel allowance.

There are two types of situations which qualify as travel allowances, namely:

- A travel allowance, made available to an employee to finance transport, which is usually a fixed rate or amount per day/month.

- A travel allowance in the form of a reimbursement of the actual travelling cost of the actual distance travelled for business purposes by an employee.

What changed?

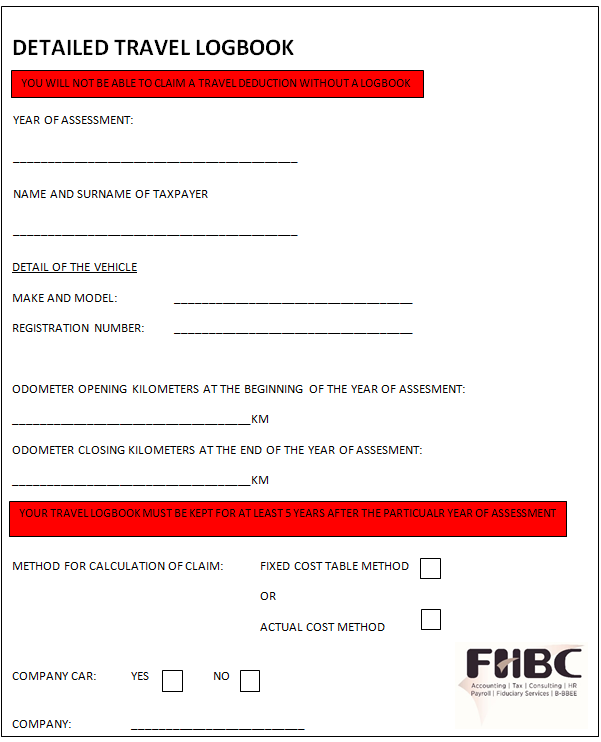

As from 1 March 2019 taxpayers are obliged to keep record not only of their business travelling, but also of their private travelling. As such, taxpayers need to keep track of all their travelling in a travel logbook. It is very important to take note that you will not be able to claim for a deduction in this regard, if you do not have a complete travel logbook for the specific year of assessment.

Moreover, the exact reading of the motor vehicle’s kilometres as reflected on the vehicle’s odometer must be recorded as at on the first day of the year of assessment as well as the reading as on the last day of the year of assessment. Once again – please note that, without these readings, you will not be able to claim a deduction.

What exactly must be recorded in a travel logbook, in order to satisfy SARS’s rules and practices?

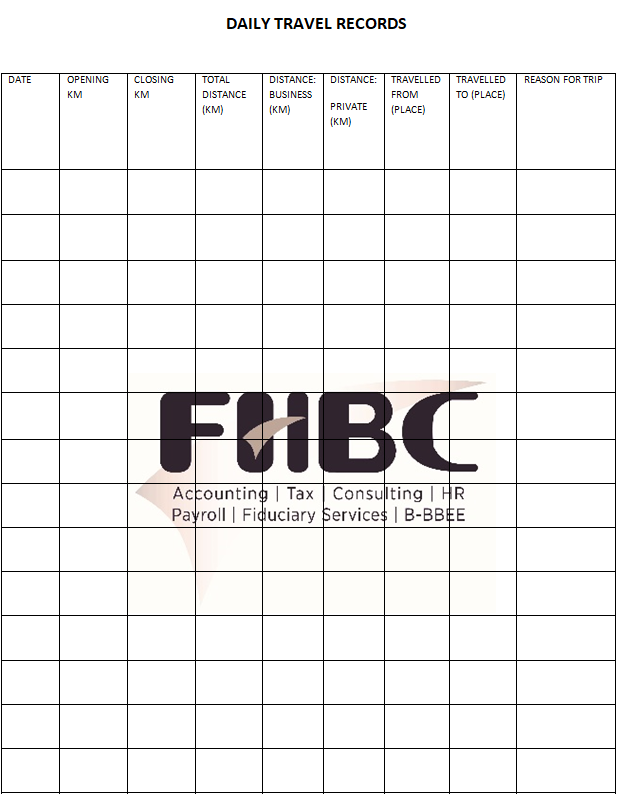

The following information must be included in the travel logbook per each trip:

- The date;

- Description of the place where you are travelling from;

- The opening kilometres of the motor vehicle (per the odometer) before you start travelling;

- Description of the place where you are travelling to;

- The closing kilometre reading of the motor vehicle (per the odometer) as at the end of the particular trip, at the destination you travelled to;

- The total distance travelled;

- The total distance which was travelled for business purposes;

- The total distance which was travelled for private purposes; and

- The reason for the trip (for example: meeting with client at client’s premises).

Lastly, have a look at the example below of how a travel logbook should look like, in order to be proactive and to comply with the new tax rules. For more information do not hesitate to send us an email or to give our office a call.

If you have any enquiries, please contact Chantél van der Merwe at c.coetzee@fhbc.co.za

Source Reference:

SARS 2019/20 logbook for the 1 March 2019 – 29 February 2020 assessment year and tax season starting 1 July 2020

SARS website: https://www.sars.gov.za/TaxTypes/PIT/Pages/Travel-e-log-book.aspx