A bit of background

A bit of background

The whole concept of carbon tax might sound quite new to the most of us, but the legislative process started way back in 2006 already and it seems as if our country’s commitment to the Paris Agreement on climate change in 2016 was the final motivation to the completion of the Carbon Tax Act 15 of 2019 (CTA), which will take effect as from 1 June 2019.

What is carbon tax exactly?

Firstly, in terms of section 3 of the CTA, any person or entity who conducts an activity which results in the emission of greenhouse gases (GHG) above the allowed threshold, will be subject to carbon tax. The implementation of this tax comes down to a “polluter-pays-principle” and the tax will be charged at R120 per tonne of carbon dioxide (CO2) emissions. This tax will form part of SARS’s Customs and Excises department and the tax return will be known as the environmental levy return for carbon tax. Thus, the Customs and Excise Act 91 of 1964 have be amended accordingly in terms of the Customs and Excise Amendment Act 13 of 2019.

Reporting and administration

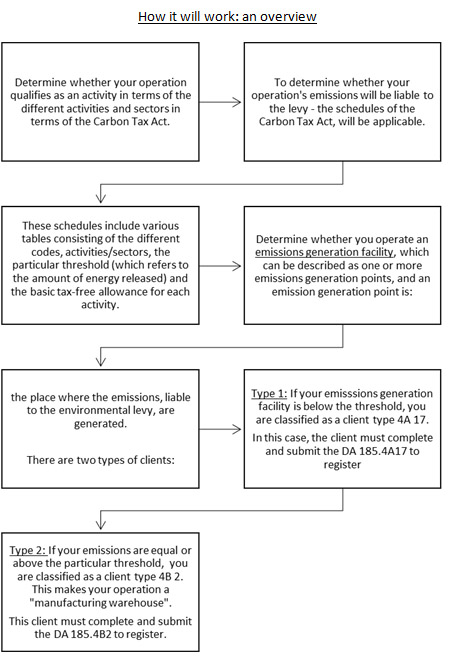

Furthermore, the South African Revenue Service (SARS) and the Customs and Excise department recently released their draft rules, schedules and forms for the implementation of the tax. SARS also included details on the carbon tax administration, the registering of clients, the licensing of emissions facilities, carbon tax environmental levy accounting as well as how the allowances will apply as tax rebates. These draft rules and documentation are still open for public comments and closes on 14 June 2019. One of the forms in this regard, is the DA 180: Environmental Levy Return for Carbon Tax, which needs to be completed and submitted by a taxpayer. The DA 180 also has annexures for the different types of GHG emissions and levies. The tax return information must be submitted via SARS eFiling on the EXD 01 return and the completed and signed DA 180 (hard copy) and its supporting documents must be kept for record purposes, but before the DA 180 can be completed and submitted, the particular person/entity must first register as a client of SARS Customs and Excise via the application form for the registration or licencing of a Customs and Excise client. This form is known as the DA 185. The form also has annexures for the different types of clients.

The following documents were drafted for the administration of the carbon tax:

- To register:

- DA 185 (Application form to register);

- DA 185.4A17 (for client’s with emissions below the particular threshold);

- DA 185.4B2 (for client’s with emissions equal or above the particular threshold);

- The tax return:

- DA180.01A.1 – Fuel combustion stationary source;

- DA180.01A.2 – Fuel combustion non-stationary source;

- DA 180.01B – Fugitive emission source;

- DA 180.01C – Industrial process source;

- The allowances:

- DA 180.02A.1 – Allowances: Fuel combustion stationary;

- DA 180.02A.2 – Allowances: Fuel combustion non-stationary source;

- DA 180.02B – Allowances: Fugitive emission source;

- DA 180.02C – Allowances: Industrial process source emission source.

The three categories of taxable emissions

Entities will be liable for their:

- Fuel combustion emissions;

- Fugitive emissions and;

- Process emissions.

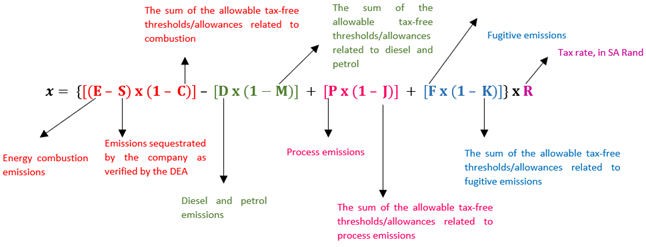

How to calculate the amount of carbon tax payable

Before the payable amount of tax can be calculated there is a lot of other values and factors which need to be calculated in order to be able to complete the section 6(1) formula for the amount of tax payable. Also, the different values have their own formulas each which must be applied. Section 4 provides for the different formulas of each of the values necessary to calculate each of the three categories of taxable emissions.

A summary of some the important sections of the CTA is provided below:

| Section | Principle |

| 1 | Definitions |

| 4 | The Tax Base, and the calculation thereof. |

| 5 | The Tax Rate |

| 6 | The Calculation of the amount of Carbon Tax payable. |

| 7 – 14 | The different allowances and the limitation thereof. |

| 15 – 17 | Administration, tax period and payment of tax |

The generous side of the CTA

The Act makes provision for several types of allowances. There is a basic tax-free allowance for all entities that generate emissions from energy combustion of 60% on actual reported energy combustion emissions (except for liquid fuel related emissions from diesel and petrol use). Additional allowances, amongst others, include allowances for each of the different types of emissions and an allowance for trade exposure (available to entities that are trade exposed and sensitive to potential international competitiveness, which comes down to a maximum allowance of 10%).

An example:

Section 6(1) of the Carbon Tax Act makes provision for the below formula, which must be used to calculate the payable tax:

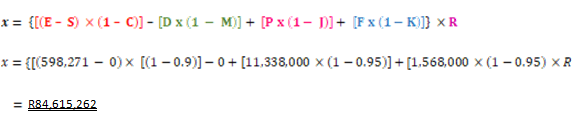

Company 3 generated:

- 1,568, 000 tCO2e fugitive emissions from coke production;

- 598,271 tCO2e combustion emissions; and

- 11,338,000 tCO2e process emissions.

Company 3 is trade-exposed, has process and fugitive emissions. It has outperformed its peers, has complied with information requirements for its carbon budgets and has decided to purchase its full carbon offset allowance. There were no sequestration activities by Company 3.

- Company 3 is eligible for the:

- basic 60% tax-free allowance for fossil fuel combustion emissions;

- 70% tax-free allowance for process emissions;

- 10% tax-free allowance for fugitive emissions;

- 10 tax-free allowance for trade exposure;

- 5% allowance according to the Z-factor calculation for outperforming its peers; and

- 5% offset allowance for fugitive and process emissions.

- Thus,

- the sum of Company 3’s allowances for fossil fuel combustions is 90%;

- the sum of Company 3’s allowances for process emissions is 95%;

- the sum of Company 3’s allowances for fugitive emissions is 95%;

The calculation

The way forward

The implementation of carbon tax isn’t just a brand-new concept for our regulatory authorities, but it also falls within its own highly specialised field of tax law which is yet to be tested by taxpayers, tax practitioners, SARS and other interested parties/stakeholders. Therefore, in order to ensure that your company will be tax compliant in terms of the Carbon Tax Act 15 of 2019 and the Customs and Excise Amendment Act 13 of 2019, it is of utmost importance to seek professional financial and legal advice.

To emphasise the importance of the record keeping of your company’s carbon footprint – please note that the first tax reporting period for carbon tax already started as from 1 June 2019 and will end on 31 December 2019. The tax returns for the latter period must be submitted to SARS via eFiling in July 2020. Additionally, you or your company will need to be proactive regarding your 2020 budget by including an amount of the estimated carbon tax your company will be liable for.

In conclusion. Although the whole concept of carbon tax, its administration and reporting methods are somewhat overwhelming, it should be remembered that this tax type and its rules, formulas and reporting system still need to be tested and can be seen as a trial and error phase. This doesn’t make it less important, but it gives scope to the assorted interpretations of the Act and the SARS forms, which will soon surface. Lastly, this article is not an official tax or legal opinion and cannot be used as such. As mentioned above, kindly contact us for more information or assistance in this regard.

Email Chantél van der Merwe at c.coetzee@fhbc.co.za or contact us telephonically at 021 864 5180.

Source Reference:

- The Carbon Tax Act 15 of 2019;

- The Customs and Excise Amendment Act 13 of 2019;

- The Explanatory Memorandum on the Carbon Tax Bill, 2018 of 20 November 2018, published by the National Treasury;

- President Cyril Ramaphosa signs 2019 carbon Tax Act into law:

https://www.gov.za/speeches/publication-2019-carbon-tax-act-26-may-2019-0000 - SARS publishes draft rules for the administration of the carbon tax:

https://www.lexology.com/library/detail.aspx?g=8dbcb0f5-59f1-4dbb-b9a2-d7f92c9891b6 - How South Africa’s new carbon tax will hit petrol prices from June and beyond:

https://businesstech.co.za/news/energy/317326/how-south-africas-new-carbon-tax-will-hit-petrol-prices-from-june-and-beyond/