This article serves as a summary of the main amendments to the tax legislation in Namibia expected to be implemented in 2019, as proposed during the 2018/2019 Budget Statement, earlier this year.

This article serves as a summary of the main amendments to the tax legislation in Namibia expected to be implemented in 2019, as proposed during the 2018/2019 Budget Statement, earlier this year.

Hierdie artikel sluit aan by Oktober se inleidende artikel van “transfer pricing” en dien as ‘n opsomming van drie van Suid-Afrika se belangrikste reëls in hierdie verband, soos ingevolge die Inkomstebelastingwet 58 van 1962.

Hierdie artikel is ‘n inleidende opsomming om meer insig oor die konsep van “Transfer Pricing” te bied. Sekere reëls is ingestel om die verlies van inkomste te voorkom. Suid-Afrika erken ook die reëls.

When you do not have the appropriate / valid documentation at the time of completing a VAT201 return you may not, according to the VAT Act, claim the input tax in that specific tax period.

Die vergoedende reistoelaag verwys na ‘n terugbetaling wat deur werknemers ontvang word wat vir amptelike doeleindes namens die werkgewer gereis het. Die toepassing van die vergoedende reistoelaag het vanaf 1 Maart 2018 verander.

There has been recent confusion about customs requirements for travellers when it comes to personal valuables – what form, what must be declared and why?

Op 16 April 2018 het die Suid-Afrikaanse Inkomstediens (SAID) ʼn nuwe inisiatief aangekondig waar daar voorts saam met die Nasionale Vervolgingsgesag (NVG) gefokus gaan word om belastingbetalers wat versuim om hul opgawes in te dien, te vervolg.

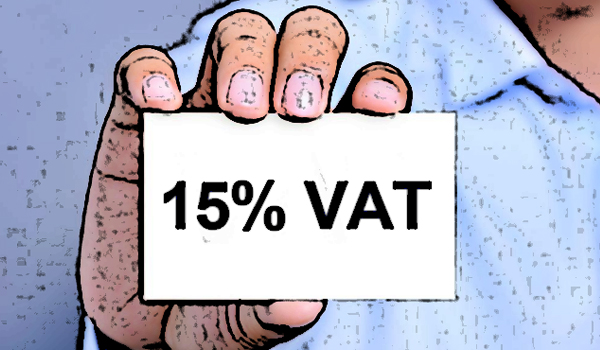

The minister of Finance announced in his budget speech of 21 February 2018 that the standard rate of VAT will increase from the current 14% to 15% with effect from 1 April 2018. As a transaction-based tax, the tentacles of VAT reach into virtually every area and system in a business.

The curtains have come down on section 18B of the Value-Added Tax Act, No. 89 of 1991 (VAT Act). If you are a property developer or have property developers as clients you need to be aware that section 18B of the VAT Act ceased to apply from 1 January 2018.

Provisional tax estimates, payments, deadlines, penalties and interest may be somewhat confusing for the tax-paying public. This article attempts to explain these concepts in layman terms.