What is an administrative penalty?

Administrative penalties (admin penalties) are fixed amount penalties which are levied by the South African Revenue Service (SARS) in terms of section 210 of the Tax Administration Act No.28 of 2011 (the TAA).

When will an admin penalty be imposed?

Individuals – Starting on 1 December 2022, an admin penalty will be imposed for all outstanding income tax returns relating to years of assessment from 2007 onwards.

Companies – Starting on 1 December 2021, an admin penalty will be imposed for all outstanding income tax returns relating to years of assessment ending in or after 2009. This will be done after SARS has issued a final demand which requires the company to file the outstanding income tax return/s within 21 business days, and the company still fails to adhere to the deadline.

Trusts – The following is anticipated: Starting on 1 March 2026, admin penalties will be imposed, only if both the 2024- and 2025-income tax returns are outstanding.

Prior to this, at the beginning of February 2026, SARS will first issue a final demand which will provide the trust a final 21-business day grace period to file the outstanding income tax return/s, after which said penalties will incur.

This will apply to all trusts registered at the Master of the High Court irrespective whether the trust is a “passive” or “dormant” trust.

In the future, SARS may possibly follow the same modus operandi currently applicable on individuals and companies and levy admin penalties, even if only one income tax return (relating to the 2024 year of assessment and onwards) is overdue.

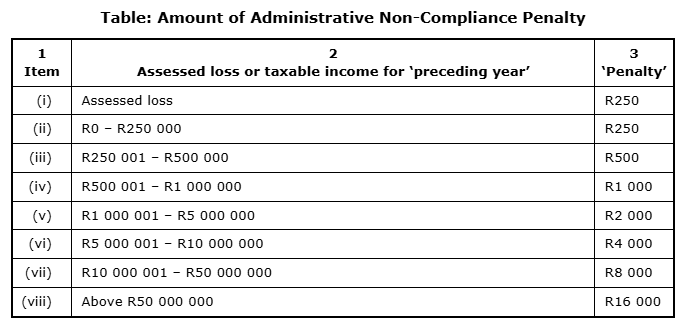

What is the amount of the penalty?

The quantum of the monthly penalty will be determined by the taxpayer’s taxable income for the preceding year. The table below, which appears in s211 of the TAA, provides the brackets and the corresponding penalties which will apply if an income tax return is submitted late.

When the actual taxable income of the taxpayer is determined on assessment and it becomes apparent that the taxpayer falls within another bracket of the admin penalty schedule, the penalties must be adjusted accordingly by SARS (section 211(5) of the TAA).

For how long can SARS levy the penalty?

SARS can levy above penalties for a period of 36 months where SARS is in possession of the current address of the taxpayer and is able to deliver a penalty assessment or 48 months where SARS is not in possession of the current address of the person and is unable to deliver a penalty assessment.

What can I do if I disagree with a penalty?

Firstly, it is important to submit all outstanding income tax returns to stop further admin penalties incurring.

Once submitted, a taxpayer has the option to dispute admin penalties if there are valid reasons applicable, such as reasonable or exceptional circumstances which prevented the taxpayer to submit income tax returns/s timeously.

The dispute must be submitted via the eFiling platform by means of a “request for remission” (RfR) application and a SARS official will then assess the merits of the taxpayer’s case and allow, partially allow or disallow the RfR.

If a taxpayer is not happy with the outcome of the RfR, there is the option to raise an objection or appeal (if the objection is disallowed) against SARS’s decision.

Closing remarks

Prevention is better than a cure. As far as possible ensure that your personal income tax return or those of your company or trust is submitted on time to prevent unnecessary admin penalties.

Where you are utilising a tax practitioner to assist you, try to furnish him or her with all the required information, well in advance of the submission deadlines, to enable him or her to prepare and submit the necessary declarations and supporting documentation timeously.

In recent times we have found that it is becoming increasingly difficult to convince SARS to remit admin penalties and therefore it is best not to incur them in the first place.

If you have any enquiries, please do not hesitate to contact Petri Westraadt at pwestraadt@fhbc.co.za

Source Reference:

1. https://www.sars.gov.za/individuals/what-if-i-do-not-agree/admin-penalty/

2. https://www.sars.gov.za/legal-counsel/secondary-legislation/public-notices/

3. https://iol.co.za/personal-finance/financial-planning/2025-11-22-trustworthy-how-trustees-should-avoid-sars-new-administrative-penalties/

4. SARS Notice 1372 (Government Gazette No. 42100, 14 December 2018)

5. SARS Notice 1531 (Government Gazette No. 45540, 26 November 2021)

6. Tax Administration Act No.28 of 2011