As part of the ongoing statutory obligations, companies and close corporations in South Africa are required to submit Annual Returns to the Companies and Intellectual Property Commission (CIPC). Failure to comply can lead to penalties, deregistration, or even legal consequences, making it essential to understand the process and ensure timely submissions.

As part of the ongoing statutory obligations, companies and close corporations in South Africa are required to submit Annual Returns to the Companies and Intellectual Property Commission (CIPC). Failure to comply can lead to penalties, deregistration, or even legal consequences, making it essential to understand the process and ensure timely submissions.

What is an Annual Return?

An Annual Return is a mandatory filing that provides the CIPC with updated information about a company or close corporation. This information ensures that the CIPC’s records are up to date and reflects the current status of the business entity.

Who must submit Annual Returns?

- All Companies (private, public, non-profit, and external companies) and Close Corporations registered in South Africa must submit their Annual Returns.

- Small and micro businesses are not exempt from this requirement, even if they are not actively trading.

When should you Submit?

- Companies must submit their Annual Returns within 30 business days after the anniversary date of their incorporation.

- Close Corporations must submit within the anniversary month of their registration.

Fees and Penalties

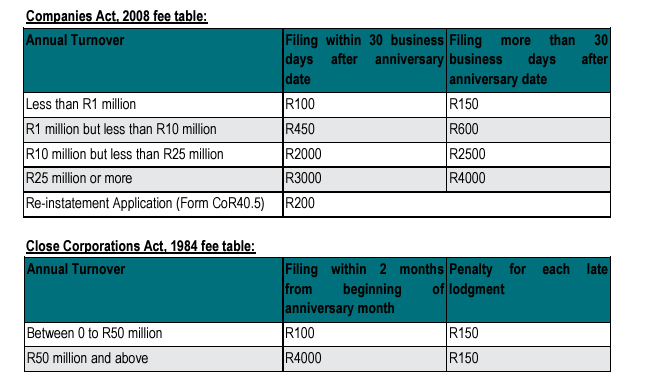

The Annual Return fees are calculated based on the company’s annual turnover. For companies with no turnover or a turnover below R1 million, the fee is minimal, while larger companies with higher turnovers pay proportionately higher fees. The CIPC breakdown of the fees are as follows:

Penalties for late submissions can accumulate, and repeated failure to submit Annual Returns can result in the company being deregistered. Once deregistered, the company loses its legal standing and must go through a formal reinstatement process to resume operations.

Benefits of compliance

Timely and accurate submission of Annual Returns offers numerous benefits, such as:

- Maintaining good standing with the CIPC.

- Avoiding unnecessary penalties or deregistration.

- Ensuring the company’s information is updated, which can be crucial for business operations and growth.

Submitting your Annual Return is not just a legal obligation but a vital step in ensuring the ongoing compliance and good standing of your company. Make sure to set reminders, follow the process on time, and avoid unnecessary penalties.

The FHBC group offers various secretarial services and assistance to our clients, including the submission of the annual returns. Should you require assistance in this regard, please do not hesitate to contact Arné Bester (arne@fhbc.co.za) or please feel free to contact our office directly at 021 864 5180.